The expectation and unbridled optimism about the AI revolution is giving way to a stage of nervous laughter. The question It is no longer whether there is an AI bubblebut when it will explode and what impact that explosion will have. It is inevitable to compare this situation with the one we experienced with the rise of the internet and the dotcom bubble, but this is even worse.

Dog years, mouse years. Vinton Cerf, one of the fathers of the internet, spoke in 1999 how “a year in the internet business was like a dog year, that is, seven years in the life of a normal person.” Everything was going very fast then, but now it is spoken of “mouse year”: each of them would be equivalent to about 35 human years. In AI everything certainly goes much faster, and that is very, very dangerous.

Stock market crashes don’t help. Until a month ago, the extraordinary optimism that existed in this market had caused the big technology companies to continue growing on the stock market while the rest of the economy barely did. NVIDIA has been the best example of this, but in the last month a good handful of technology stocks have fallen. NVIDIA itself, (-4%), Microsoft (-10%), Meta (-20%), Amazon (-2%), Broadcom (-4%), Oracle (-30%), AMD (-20%), Intel (-10%). Only Google (+15%) and Apple (+3%) seem to resist this downward trend.

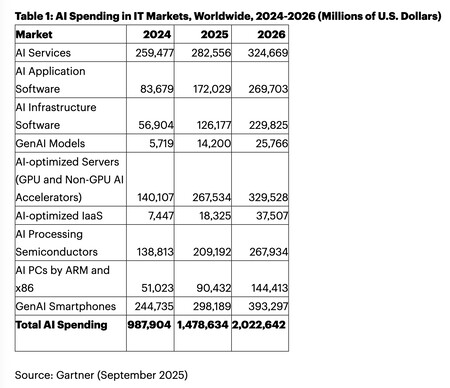

The bubble is huge. The last estimates for capital expenditures (capex) added to the investments of venture capital already exceeds 600,000 million dollars by 2025, and the consulting firm Gartner indicated that according to its data in 2025, spending related to AI will amount to 1.5 trillion dollarswhen in 2024 it was 988,000 million. By 2026, it is estimated that it will exceed two trillion dollars.

And it has grown much faster. As explains Analyst Fred Vogelstein, that spending “is happening in a fraction of the time. The internet bubble inflated for 4.6 years before bursting. The AI bubble has inflated in two-thirds of that time.” The numbers continue to grow without stopping, they get bigger and they start to make no sense. And when they don’t make sense, they probably don’t really make sense.

Too much concentration. There are differences between this bubble and the dotcom bubble. For example, much of the gigantic investment in data centers comes from technology companies themselves, and not so much from venture capital or investment firms. Even so, the concentration is enormous: Microsoft, Alphabet, Meta, Amazon, NVIDIA, Oracle and Apple represent approximately a third of the critical S&P 500 market, which was already aiming for it years ago, even before everyone started talking about AI. We have already seen this year how if technology companies fellthe economy suffered noticeably.

This is not an investment, it is a bet. Companies like Microsoft, Alphabet, Meta or Amazon are talking about projected capital expenditures (capex) of $70 billion to $100 billion in data centers. These companies are risking everything on AIwhen at the moment there is no reasonable justification to do so because the uncertainty is total. The best way to understand that philosophy is to remember what Mark Zuckerberg said about his investment in AI:

“We’re going to invest aggressively. Even if we lost a couple hundred billion dollars it would be a bummer, but it’s better than being left behind in the race for superintelligence.”

Or what is the same: if you don’t risk, you don’t win.

OpenAI, bubble paradigm. If there is a company that represents the AI madness, it is OpenAI. This valued at 500 billion dollarsbut the company itself estimates that until 2029 you will not start earning money. It is estimated that its “cash burn” in 2025 will be $8 billion, and that in 2026 that figure will be $17 billion. It’s growing in revenue, yeahbut not at a sustainable pace at the moment. The accounts don’t come out, but the important thing for Sam Altman (and his investors) is that theoretically they will end up coming out. Or so they say.

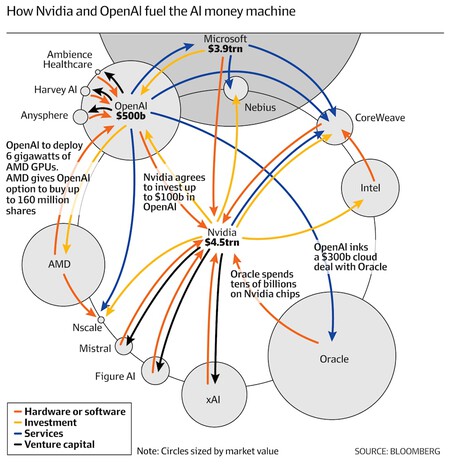

Source: Bloomberg.

Circular financing. We are experiencing another warning sign with the recent circular financing agreements between big companies technological. In these alliances OpenAI and NVIDIA (among others) are becoming something like banks and investors that guarantee the demand for their products. This means that these companies will probably emerge stronger, but it also increases the systemic risk of this bubble burst. We are seeing it with Oracle, which issued $18 billion in bonds and has raised its total debt above $100 billion. Others are in a compromising situation also.

Crazy reviews. And we have more disturbing warnings, of course. Among them, those that affect the multimillion-dollar investments and valuations that AI startups are receiving. Reflection AI, the company founded by two former Google DeepMind researchers, has raised 2000 million dollars in one round, while Safe SuperIntelligence, the startup created by Ilya Sutskever, is valued at 32 billion dollars without having any public product. It is estimated that there are 498 AI unicornsand it does not seem that the investment fever has stopped, as demonstrated by the interest in Yann LeCun’s imminent startup.

Altman, Nadella and Pichai warn. Even the technological leaders They recognize that there are signs of a technological bubblealthough they do it with nuances. Pichai talked about observing “elements of irrationality”, and in that same vein they were Satya Nadella (Microsoft) or Sam Altman (OpenAI). Meanwhile, Robin Li, CEO of Baidu, explained months ago that we are facing a bubble that will make only 1% of companies survive.

China. This excessive spending has also been helped by the rise of China in this area. The Asian giant has demonstrated its ability to develop open models extraordinary. The DeepSeek effect It caused companies in the US to add even more fuel (money) to the fire while China takes a position more conservative. Mastering AI is a major national security concern and that ties assessments to political and tariff unpredictability.

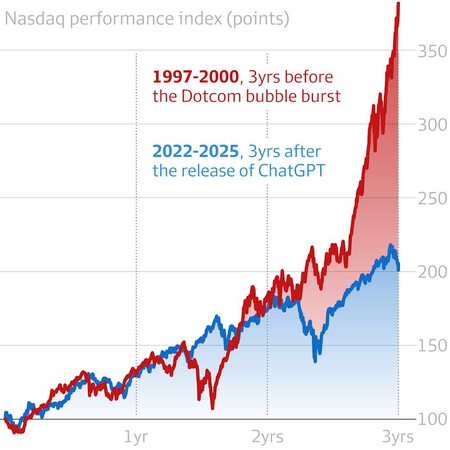

Source: Financial Review

But this bubble is not like the other. Although everything seems crazy, if you look back you realize that there are signs that make it clear that (for the moment) the situation is not entirely comparable to that of the dotcom bubble. In Financial Review For example, they compare the Nasdaq technology stock performance index, which was absolutely skyrocketing three years before it exploded. In the case of AI, this growth, although notable, is not that great. There are other factors that they allude to and that seem to suggest that the situation is disturbing, but not alarming:

- Stocks up, but not that much: The Nasdaq index grew 281% in the three years before the dotcom bubble burst. Today the growth of the index is 100%.

- Valuations are not so high: Harvard economist Jason Furman explained in NYT his argument with the so-called Shiller CAPE, a measure of the P/E ratio which evaluates whether a stock is expensive or cheap. Now it is at 40, while in the dotcom bubble it was at 44.

- Technology companies earn (a lot) of money. The “Magnificent Seven” They have a total of about $200 billion in cash on their balance sheets. Additionally, they have combined revenues of $2.1 trillion and a market capitalization of $20.8 trillion. Wrong, what is said wrong, does not suit them.

Image | Aedrian Salazar

GIPHY App Key not set. Please check settings